Leaving a lasting legacy

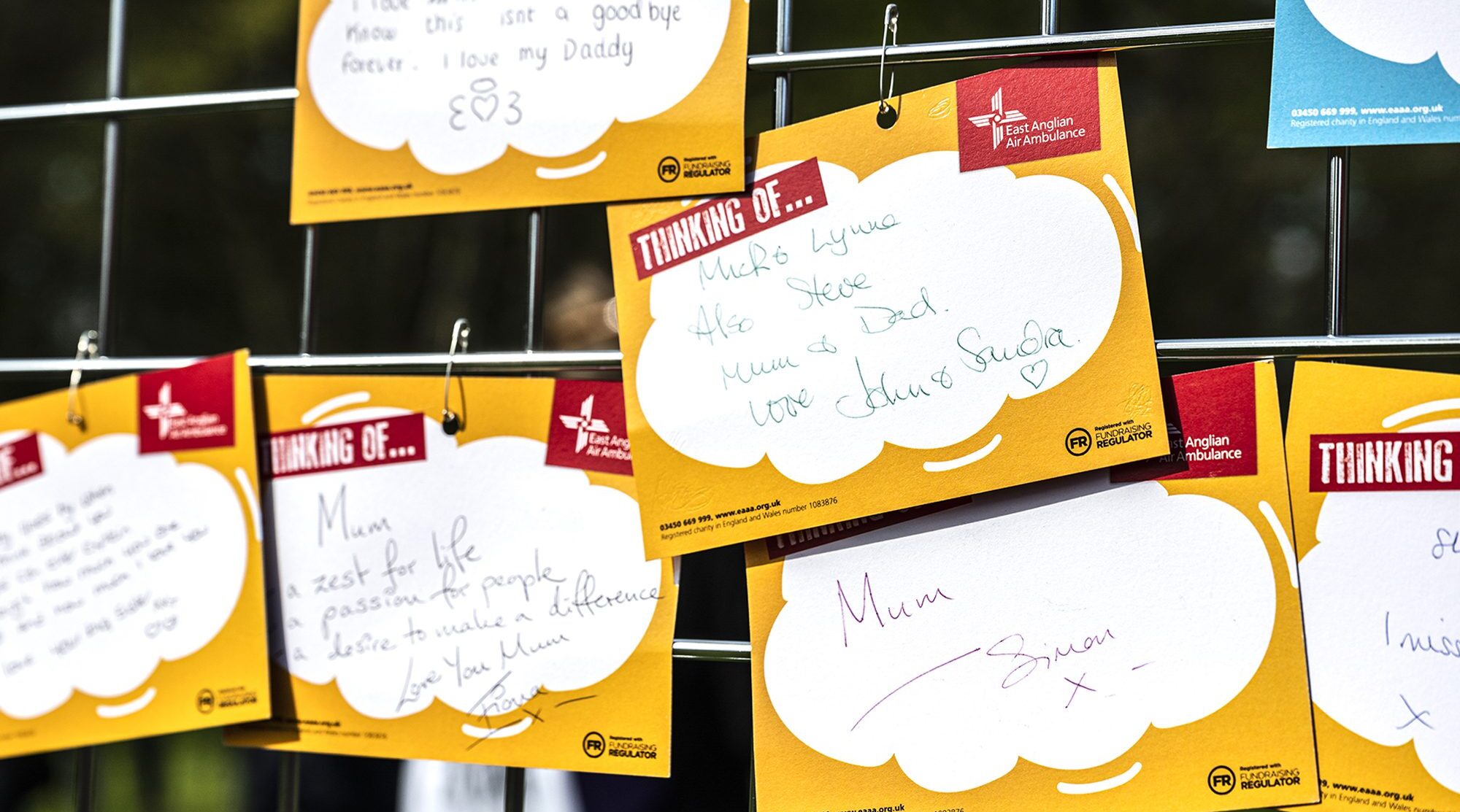

Someone’s future could depend on what you do today. Help save lives by protecting your air ambulance with a gift in your Will.

Why Gifts in Wills matter

These incredible gifts fund one in four of our emergency missions giving future generations, not only the best chance of survival, but for going on to live a fulfilling life.

There are no boundaries when it comes to giving people the care they need. Your gift will make sure that a highly skilled medical crew is at a patient’s side within minutes. No matter where they are in the region, or when they need us, we will be there to deliver advanced life-saving treatment on-scene, thanks to you.

Make a life-changing decision today

Every day, people like you change the course of someone’s life.

Circumstances can change at the flip of a coin. What feels like an ordinary day can suddenly become one of the worst days in somebody’s life. When that happens, you can be there for those people who suddenly need EAAA’s urgent 24/7 critical care and ongoing support.

Your legacy will be one that is remembered for replacing fear with hope; a second chance at life; and keeping loved-ones together. Your gift will save lives.

Download your free Gifts in Wills guide to find out how to write or update your Will and understand more about the impact your life-saving gift could make.

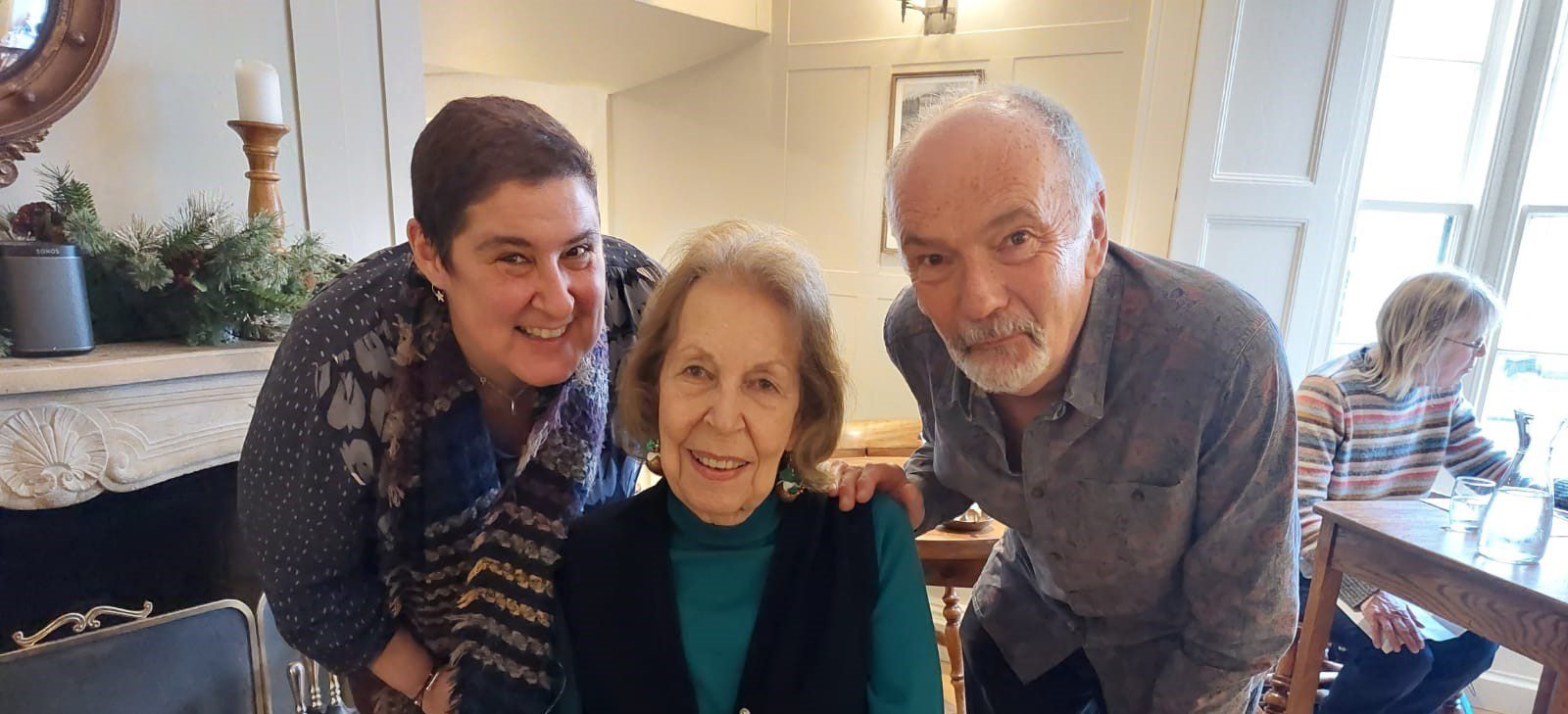

Their Story, your legacy

Some of our patients have decided to share their story to show how thankful they are to those who have given them the gift of life.

In 2024 alone, our crews treated 1,941 patients across the region; one in four were possible thanks to people like you.

Someone’s future could depend on what you do today

If you have made the decision to join with those who are ensuring the future of critical, out of hospital emergency care by leaving a gift in your Will, but are yet to write it, you can do so for free via our Free Wills Scheme. A gift, no matter what the size, left to EAAA, will help to save lives for years to come.